The AI Bubble Is a Ticking Time Bomb. If It Pops, so Will the U.S. Economy.

And the U.S. economy is still heavily linked to the performance of the global economy. Here's what you need to know and how you can prepare.

The last section of this post is only available for paid subscribers. If you’d like to read it and all the other articles in the Reality Studies archive to help you decide if you’d like to become a paid subscriber, I encourage you to use the 7-day free trial option:

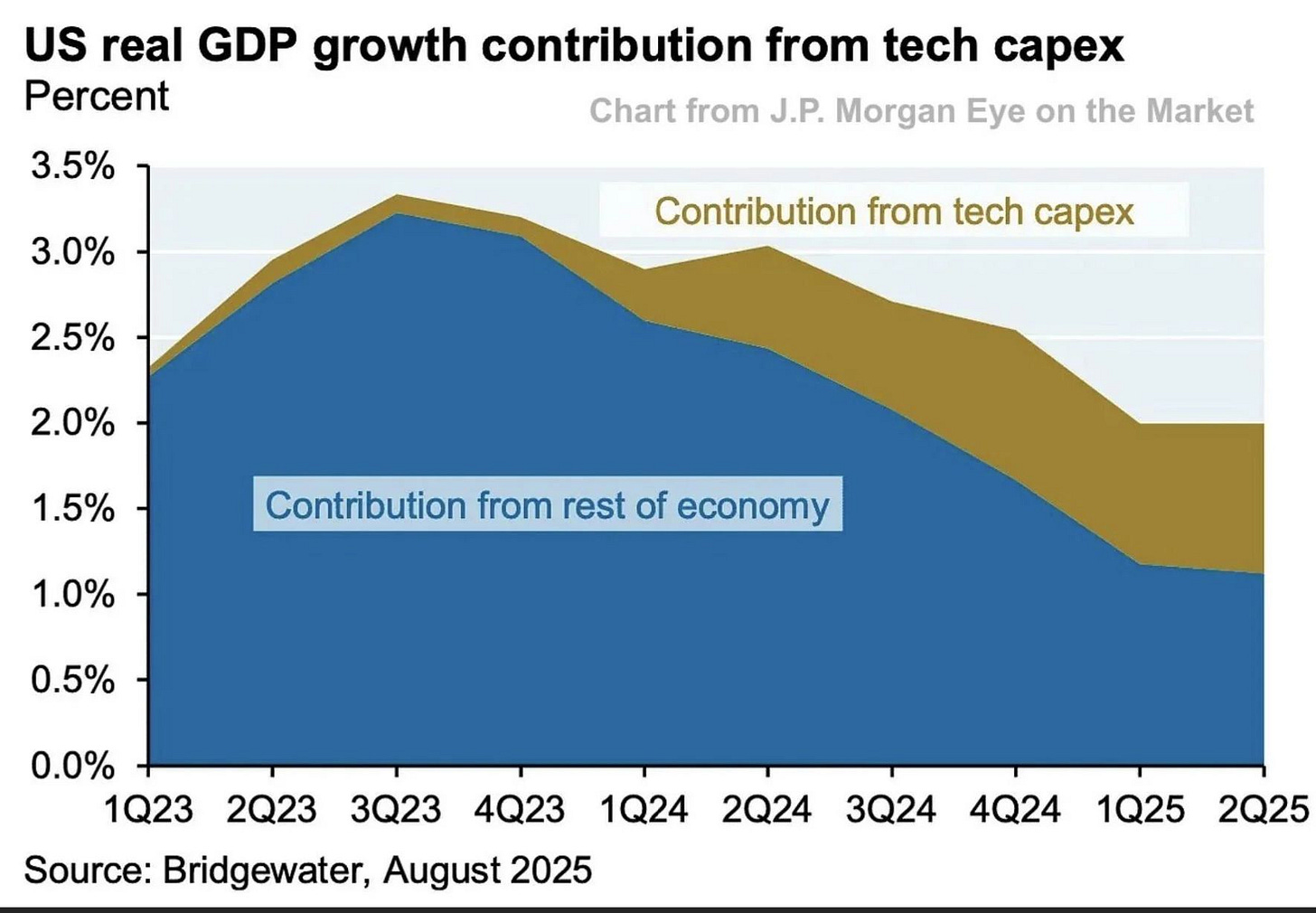

The last two years of U.S. economic outperformance have been unusually concentrated in one sector: artificial intelligence. But AI exuberance isn’t just a stock-market story; it’s a capital expenditure (capex) boom that has yanked growth onward and upward in everything from construction to utilities, semiconductors to cloud computing to venture funding.

To give you a sense of just how much of America’s growth is pegged to AI, here’s a quote from Paul Kedrosky in a July column in the Wall Street Journal:

[O]ne explanation for the U.S. economy’s ongoing strength, despite tariffs, is that spending on IT infrastructure is so big that it’s acting as a sort of private-sector stimulus program.

Capex spending for AI contributed more to growth in the U.S. economy in the past two quarters than all of consumer spending, says Neil Dutta, head of economic research at Renaissance Macro Research, citing data from the Bureau of Economic Analysis.

Understandably, this has caused many analysts to worry about the formation of an AI “bubble,” a term used to describe the phenomenon where the price of a given asset increases far above its actual value, often driven by speculation and investor euphoria. This was the case with the so-called “dot-com bubble,” in which then early Internet companies were overvalued, and ultimately crashed, as well as the 2008 housing bubble, often called the “subprime mortgage crisis,” which resulted in the Great Recession.

As with the aforementioned, if we are now witnessing an AI bubble, and that bubble bursts, the blast radius will not be contained to Silicon Valley. It will ripple through the U.S. economy, creating the kind of cascading slowdown that I believe will feel a whole lot more like a full-on crash than a small “contraction.”

To be clear: I’m not arguing that we ought to keep propping up a prospective AI bubble. I’m attempting to map what I perceive to be a looming risk on the near-ish horizon based on my foresight training, and offer strategy recommendations based on that risk. But if you want a good sense of how I think you should be thinking about AI in society, this is a topic I cover frequently on the Urgent Futures Podcast, including these episodes:

Is it Actually an AI Bubble?

A bubble is when speculation exceeds intrinsic valuation; expectations race ahead of realizations—prices, investment and financial conditions are set by what people think will happen, not necessarily what has happened. Bubbles pop when these bets don’t pay off—when the hype can no longer sustain the lack of real-world evidence, causing investors to scramble for the escape hatch to minimize their losses.

It should be noted that there remains ongoing debate about whether or not the AI hype in fact constitutes a bubble, as described by Rogé Karma in an essay for The Atlantic:

[E]vidence is piling up that AI is failing to deliver in the real world. The tech giants pouring the most money into AI are nowhere close to recouping their investments. Research suggests that the companies trying to incorporate AI have seen virtually no impact on their bottom line. And economists looking for evidence of AI-replaced job displacement have mostly come up empty.

None of that means that AI can’t eventually be every bit as transformative as its biggest boosters claim it will be. But eventually could turn out to be a long time. This raises the possibility that we’re currently experiencing an AI bubble, in which investor excitement has gotten too far ahead of the technology’s near-term productivity benefits. If that bubble bursts, it could put the dot-com crash to shame—and the tech giants and their Silicon Valley backers won’t be the only ones who suffer.

For my part, I do believe this is a bubble—with all requisite disclosures that I’m not an economist and nothing I write here is financial advice—the primary questions I have at this point are: how big has that bubble already gotten? How much bigger will it get before it crashes? What will a crash mean for the U.S. (and therefore global) economy—especially given the economic turbulence that has already been created by the Trump administration?

Investors seem to be pricing in a future of unbroken demand for chips, data centers, and generative AI applications, and valuations have reached astronomical levels. Nvidia trades at ~54 times its actual earnings, while Microsoft, Alphabet, Amazon, and Meta are investing at capex levels that dwarf historic norms. Venture capital has followed suit, with AI absorbing 57.9% of all global venture capital funding in early 2025 (read that stat again) and a growing share of venture debt. The stock market itself has become hostage to this concentration: the “Magnificent Seven” dominate the S&P 500, with Nvidia alone accounting for close to 8% of its weight. Most alarmingly, a recent Financial Times report—ominously titled, “America is now one big bet on AI,” found that the hundreds of billions of dollars companies are investing in AI account for an eye-watering 40% share of all U.S. GDP growth in 2025.

This is precisely the setup that has defined past bubbles—prices, flows, and entire indices tilting on the assumption that a single technological narrative will keep delivering.

Again, it’s important to remember that this isn’t just about markets in the abstract. AI has become the engine of U.S. growth in measurable ways. National accounts data show that business investment in IT equipment, software, and data-center structures accounts for almost the entirety of U.S. GDP growth in the first half of 2025. Data-center construction has surged to annualized highs of around $40 billion, a figure unmatched in U.S. history, while power consumption forecasts from both the EIA and IEA point to AI-driven loads reshaping America’s electricity mix. Hyperscalers, large-scale cloud service providers that operate massive data centers and networking infrastructure, are spending tens of billions each quarter to meet demand, with combined capex from Microsoft, Alphabet, Amazon, and Meta projected to reach $350 billion this year and $400 billion in 2026.

Even household consumption is being buoyed by AI. The stock market wealth effect is no longer broad-based but heavily tethered to the outperformance of AI-linked firms, which have accounted for the bulk of index-level returns. In short, the U.S. growth “beat” relative to other advanced economies has coincided directly with the AI investment supercycle.

Thus, a reversal would be nothing short of cataclysmic in the cross-category cascade it would likely induce. If hyperscalers or enterprises slow AI investment, the contraction would strike several sectors at once: construction, semiconductors, utilities, electrical equipment, and software. The stock market would feel the effects almost immediately. With so much wealth concentrated in a handful of companies, a correction in AI-linked names would drag retirement accounts and passive investment vehicles down with it, eroding household net worth and weakening consumption. At the same time, the financial plumbing behind the boom is fragile. Much of the AI buildout has been funded through vendor financing, leasing arrangements, and debt collateralized by future compute contracts. Should resale values of chips fall or demand forecasts slip, weaker firms in this ecosystem—especially niche data-center builders and cloud intermediaries—would face credit stress that could spread more broadly.

The energy sector would be caught in the whiplash as well. Utilities and grid operators are rapidly expanding to accommodate expected AI demand, with some forecasts (including by the U.S. Department of Energy) projecting data centers consuming roughly 10% of U.S. electricity within a few years. If that demand under-delivers, capital-intensive grid and generation projects may no longer pencil out, leaving stranded assets and stalling the broader “reindustrialization” narrative that policymakers have been celebrating. Venture capital and startups would also feel the shock. With the aforementioned 57.9% of global VC dollars in early 2025 flowing into AI and venture debt following the same path, a re-rating of AI expectations would leave other sectors starved of capital, depressing growth and employment in startup-heavy regions.

How the Bubble Could Burst

The potential triggers for such a downturn are not hypothetical. If enterprises fail to realize near-term productivity or revenue gains from AI adoption, investment will slow. If the global supply of GPUs normalizes, undermining the economics of compute resale and leasing models, financing structures will unravel. If grid bottlenecks or regulatory interventions delay deployment, the returns on massive data-center spending will fall short of expectations. Any of these could be enough to pop the bubble, and together they make the current trajectory unusually vulnerable.

In an August post on The Rip Current, Jacob Ward explains why he sees early indicators for these types of triggers. He argues that OpenAI’s recent insistence on the real-world value in customers’ lives and practical application(s) during the launch of their flagship large language model, GPT-5, signals increasing pressure on the AI giant to start delivering actual return-on-investment after a few years of loss-leading hype:

In a recent episode of the Urgent Futures Podcast we recorded (which will be released in a few weeks!), he further expressed alarm about the recent announcement that Nvidia would be investing $100 billion in OpenAI—this type of circular seller-investing-in-customer entanglement only amplifies risk.

The chain reaction is easy to picture. Earnings disappointments from the AI leaders would translate into weaker guidance on capex, which in turn would hit semiconductor makers, cloud providers, and infrastructure firms. Stock prices would follow, dragging household portfolios lower and dampening consumer spending. Canceled construction projects and delayed utility expansions would ripple through employment and industrial output. Credit conditions would tighten, first for AI startups and then for the broader venture ecosystem. What begins as a technology correction could then cascade into a broader economic downturn.

Skeptics argue that this cycle is different, pointing to genuine earnings strength at firms like Nvidia and to credible long-term productivity potential. That much could be true: generative AI may well transform industries over a decade or more (in ways good, bad, and ugly). But markets, utilities, and builders are not priced for gradual gains. They are priced for explosive, immediate, and sustained demand. If the payoff curve proves flatter in the near term—as history suggests it often does—the economic impulse turns negative just as quickly as it turned positive (if not quicker).

What to Watch

The signals to watch are straightforward. Capital expenditures guidance from hyperscalers for 2026 and beyond will reveal whether they see momentum continuing. Data-center construction figures, which have so far only risen, will show whether the building boom is peaking. Power-demand revisions from official agencies will highlight whether the AI load is truly materializing at scale. And stock-market breadth will continue to serve as a warning: if the health of the U.S. economy rests on the performance of two or three companies, the foundation is almost comically thin.

We must remember that America’s recent economic resilience has not been the product of broad dynamism but of a singular bet on AI. That bet has supported GDP, construction, energy, finance, and household wealth—but it has also left the U.S. economy balanced on a knife’s edge. If the bubble pops, it will bring the entire American growth story crashing down with it—at an already perilous moment in geopolitics, thanks to President Trump’s disastrous economic and trade “policies.”

What Can We Do to Collectively Prepare?

If the past 2-3 years have been a high-wire act balanced on the AI industries hype and promises, the next phase will determine whether the U.S. economy builds a safety net—or keeps walking along the tightrope without one. There are no simple fixes for a bubble this large and intertwined with real economic activity, but there are several steps policymakers, investors, and firms can take to soften the landing if expectations deflate.

As with so many things in our lives, diversity is the answer. In the case of the prospective AI bubble, investors ought to diversify sources of economic growth. (We’ll leave aside my own gripes about America’s obsession with endless growth for a moment). The concentration of capital, talent, and policy attention around AI has starved other sectors of investment. Redirecting some fiscal incentives and credit flows toward neglected areas—here I’ll bang my drum for more robust investment in housing, public infrastructure, and clean energy—can reduce dependence on a single technology. Economic resilience depends on breadth, not just depth, such that future damages in any one sector remain (more) localized.

We also have to weaken the feedback loop between financial markets and infrastructure build-out. Current utility planning, grid expansion, and chip-fabrication decisions are being made under the assumption of uninterrupted AI demand growth. Regulators and utilities should adopt scenario planning that includes lower-than-expected demand trajectories, to avoid stranded assets if forecasts don’t materialize. The added benefit here, of course, would also be less of a drain on energy infrastructure and less harm to the environment in the form of greenhouse gas emissions and drinking water waste (for cooling data centers).

As a foresight strategist, I’m strongly of the mind that we must improve the quality of demand forecasts and public data. The speed and opacity of AI-related build-out have outpaced the ability of agencies like EIA and FERC to provide timely data. A more transparent and standardized reporting framework for data center electricity demand, construction pipelines, compute investments, and greenhouse gas emissions would help both the public and private sectors make more realistic plans.

Obviously, we also have to build countercyclical buffers now, which will constitute a far less costly use of our time and money than “clean-up” after the bubble pops. Corporate treasurers, venture capitalists, and policymakers should treat today’s boom as temporary windfall revenue, not permanent baseline. That means resisting the temptation to ratchet up permanent spending commitments and instead using some of the gains to shore up balance sheets, invest in productivity-enhancing public goods, or pay down debt. Fiscal space and financial stability will matter enormously if the tide turns.

Most broadly, we all must recognize that the narrative itself shapes outcomes. We have to get clear-eyed about what AI actually can and cannot do now and in the immediate future, rather than obsessing over far-future hypotheticals. Much of the AI boom has been driven by expectations of explosive returns—on the back of promises made by companies and investors who stand to directly benefit from said boom. We have to temper that narrative to reduce systemic fragility. It’s already clear that, while AI may hold promise as a transformative technology some day, it is not currently living up to demand, creating far fewer real-world examples of genuine innovation than the tech oligarchs have been proclaiming are right around the corner for the past three years. If we get really honest with ourselves, we’ll be better equipped to act thoughtfully. There is no reason that AI needs to be developed at breakneck speed—and moreover, a whole lot of reasons why it shouldn’t be.

As much of an advocate for degrowth and post-growth as I am, I have to point out that if we retreat in panic as rapidly as we surged in hype, we’ll pop the bubble, which will indeed yield degrowth but in a fashion that harms billions of people. So as much as AI critics may want us to abandon the technology altogether, that’s not actually realistic under the lens of systemic wellbeing—at least in the near term.

Instead, what we need is a prudent ramp down in speed, to build a more sensible foundation upon which to develop the technology using the infrastructure (of various kinds) that has already been built. If the bubble does burst, as bubbles tend to do, this kind of preparation could mean the difference between a tummy ache and a full-blown global economic crisis.

What Individuals Can Do to Prepare

Bubbles are collective phenomena, but their aftermath is experienced individually. If the AI boom pops, the effects will ripple through household wealth, job markets, and local economies. It’s impossible to fully insulate yourself from such a macroeconomic shock, but there are practical steps you can take to build resilience now.